David J. Kupstas, FSA, EA, MSEA Chief Actuary

True or false: how much a Highly Compensated Employee is allowed to contribute to a 401(k) plan may depend on how much Non-Highly Compensated Employees and other HCEs choose to contribute. At first glance, the answer to that question would seem to be false. How much salary to defer into a 401(k) is a personal decision. Why should it matter what other employees are contributing?

As you might have guessed (since we’re devoting a whole article to this topic), the answer is actually true. Something called the ADP test tells you whether HCEs are deferring too much of their salary compared to the NHCEs. Whether you think the ADP test makes sense or not, it has been around for decades and doesn’t look to be going anywhere anytime soon. So here is a brief lesson on what this test is all about.

ADRs, ADPs, HCEs, and NHCEs

What does ADP even stand for? It stands for Actual Deferral Percentage. Many people think it stands for Average Deferral Percentage which, come to think of it, probably makes more sense than Actual Deferral Percentage. Too bad they didn’t ask us.

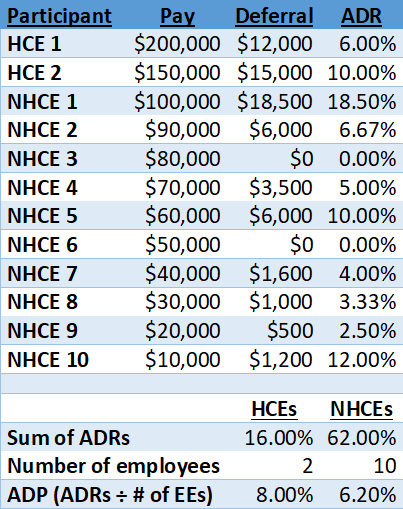

As part of the test, an ADP is determined for the HCEs, and an ADP is determined for the NHCEs. The ADP is the average of the ADRs for each employee being tested. ADR stands for Actual Deferral Ratio. (And that is almost our last acronym in this post.)

The first step in the ADP test is to determine the ADR for each employee. The ADR is equal to the employee’s deferrals divided by the employee’s compensation for the year. An employee making $50,000 who defers $5,000 has an ADR of 10.00%. ADRs are calculated to the nearest hundredth of a percentage point. Simple enough so far?

Next, the ADP is calculated for the eligible HCEs and the eligible NHCEs. The ADP for each of these groups is the average of all the ADRs for the group, calculated to the nearest hundredth of a percentage point. Here is an example:

At least two things about this example are noteworthy. First, an employee who defers $0 is counted in the test with an ADR of 0.00%. Second, there is no weighting based on how much you earn. The ADRs for the HCEs are simply averaged together even though HCE 1 makes more money than HCE 2 and should theoretically be weighted more heavily than HCE 2. Likewise, NHCE 10 is responsible for 12 percentage points of the NHCEs’ ADP, which is a lot higher than NHCE 2’s 6.67 percentage points, even though NHCE 10 defers only $1,200 compared to NHCE 2’s $6,000.

At least two things about this example are noteworthy. First, an employee who defers $0 is counted in the test with an ADR of 0.00%. Second, there is no weighting based on how much you earn. The ADRs for the HCEs are simply averaged together even though HCE 1 makes more money than HCE 2 and should theoretically be weighted more heavily than HCE 2. Likewise, NHCE 10 is responsible for 12 percentage points of the NHCEs’ ADP, which is a lot higher than NHCE 2’s 6.67 percentage points, even though NHCE 10 defers only $1,200 compared to NHCE 2’s $6,000.

What the NHCEs Defer Affects What the HCEs May Defer

Now it’s time to see whether our ADP test passes. The HCE ADP is allowed to be higher than the NHCE ADP, but only by a certain amount. Just how much higher the HCE ADP is allowed to be depends on what the NHCE ADP is:

- When the NHCE ADP is 2.00% or lower, the HCE ADP can be no more than double the NHCE ADP. If the NHCE ADP is 1.00%, the HCE ADP may not exceed 2.00%.

- For NHCE ADPs between 2.00% and 8.00%, the HCE ADP can be no more than two percentage points higher than the NHCE ADP. If the NHCE ADP is 4.00%, the HCE ADP may not exceed 6.00%.

- For NHCE ADPs greater than 8.00%, the HCE ADP can be no more than 1.25 times greater than the HCE ADP. If the NHCE ADP is 12.00%, the HCE ADP must be no more than 15.00%. (In this case, you’ll want to celebrate having such strong participation from your NHCEs).

The ADP test in our example is satisfied because the HCE ADP of 8.00% is less than two percentage points greater than the NHCE ADP of 6.20%.

Current Year vs. Prior Year Testing

If an ADP test fails, some corrective action needs to be taken. Usually, a failed ADP test means HCEs will have to have some of their deferrals refunded. Making a Qualified Nonelective Contribution (QNEC) or a Qualified Matching Contribution (QMAC) to NHCEs is another way to correct a failed test. These corrective measures are a hassle at best and quite expensive at worst. It would be better if the HCEs limited their deferrals up front to amounts that wouldn’t cause an ADP failure.

Trouble is, it’s not possible to know what the upcoming year’s NHCE deferrals will be so the HCEs can plan accordingly. If you take a guess what the NHCEs will defer, but the NHCEs defer less than expected, a failing test might occur even if HCEs had cut their deferrals back based on last year’s ADP test. If the NHCEs defer more than expected, then the HCEs might have cut themselves back too much and left some deferral opportunities on the table. Is there a solution?

This is where prior year testing comes in. Comparing the current year’s HCE and NHCE ADPs at the end of the year is called, appropriately, current year testing. Under prior year testing, the HCEs’ maximum ADP is based on the NHCE ADP from the previous year. This allows HCEs to be able to know with precision how much they as a group can defer. Had prior year testing been used in the above example, the 8.00% ADP for HCEs would have been compared not to the 6.20% NHCE ADP for the current year, but rather to the NHCE ADP for the previous year. The 6.20% NHCE ADP for the current year would have been used in next year’s testing. The HCEs could budget appropriately knowing their ADP must be limited to 8.20% (6.20% plus two percentage points) in the upcoming year.

Whether a plan uses prior year testing or current year testing must be spelled out in the plan document. The method may not be changed every year. Generally, a plan may switch from prior year testing to current year for any plan year, but a plan may go from current year to prior year testing only if current year testing has been used for the last five plan years or for the entire life of the plan, if less.

If a plan has elected prior year testing and it is the first year of the plan, the HCE ADP may be compared to the current year NHCE ADP, meaning the first year NHCE ADP will be used in the first plan year and then again in the second year when true prior year testing kicks in. Or, the prior year NHCE ADP may be assumed to be 3.00%, meaning the maximum HCE ADP could be 5.00% in the first year.

Special rules apply for the prior year testing method if there has been a significant change in who is covered under the plan.

Additional Remarks

- Employees excluded from the plan because of minimum age and service requirements are disregarded for the ADP test. Same for employees excluded from the plan based on some criteria such as job title or location, although under the coverage rules there are limits on how many employees may be excluded from the plan in this manner.

- Employees who are eligible to make deferrals but choose not to are included in the ADP test with a 0.00% ADR.

- Typical eligibility requirements are attainment of age 21 and one year of service. If a plan has more lenient eligibility (say, age 18 and six months of service), it may run separate ADP tests for participants who have attained age 21 and one year of service and those who have not met these criteria. This is an option the employer would choose if it helped them achieve a passing ADP test.

- There is a similar test for matching contributions called the Actual Contribution Percentage (ACP) test.

- A plan may avoid ADP and ACP testing by becoming a safe harbor plan.