David J. Kupstas, FSA, EA, MSEA Chief Actuary

Recently, we wrote about the challenges of determining retirement plan compensation for owners of S Corporations. Today, we will take a look at how plan compensation for sole proprietors is determined. The task is a bit harder for sole proprietors than it is for S Corporation owners.

The plan compensation that applies to a sole proprietor is called “earned income.” You can’t find this number anywhere. No one can hand you a form or tax return and say, “Show me where to find earned income.” You have to derive it yourself.

Getting the Right Data is Crucial

When you’re tackling a project in your house or yard, the first thing you should do is identify all the tools and equipment you will need. Likewise, before getting started on calculating sole proprietor earned income, we should make a list of the items we will need for our calculation:

- Form 1040, Schedule C completed with everything except retirement plan contributions

- Form 1040, Schedule SE

- Desired contribution for the sole proprietor

- Desired contribution for all other employees

For items 1 and 2, the best bet is to obtain copies of both of these completed schedules. If that is not possible, it should be specifically asked, “What is line 31 from Schedule C?” “What is the deduction for one-half of the self-employment tax from Schedule SE?” If you get an income number from the CPA or the sole proprietor himself but are not told where the number came from, you cannot be assured that is the number you need. So many terms – income, earnings, revenue, compensation – can mean different things in different situations. Make sure you know exactly what you are getting.

Round and Round with the Circular Calculation

Assume there are no employees besides the sole proprietor. The earned income is equal to

- Net profit from Schedule C (line 31)

- Less the one-half self-employment tax deduction from Schedule SE

- Less the employer contribution to the sole proprietor

The result of this calculation is the earned income which we can then use to determine the sole proprietor’s employer contribution.

If you were reading carefully, you may be saying, “Huh? You need the earned income to determine the sole proprietor’s contribution, but the sole proprietor’s contribution goes into the earned income calculation.” Good observation! It is a classic chicken-and-egg question. You need the contribution to find the earned income, but you need the earned income to find the contribution, but you need the contribution to find the earned income, and so on. That is why this is known as a circular calculation. Or, as one of my former colleagues called it, a “round-robin calculation.” Fortunately, there are some basic mathematical tricks you can use to cut down on your calculation time. Microsoft Excel has some tools to help as well, as do other spreadsheet programs.

A Simple Earned Income Example

Suppose a sole proprietor has net business profit of $60,000 from Schedule C. He wants to make an employer contribution of 10% of pay to himself. What is his earned income? What is his contribution?

The first thing to do is figure out the one-half self-employment tax deduction. A sole proprietor has to pay both the employee and employer portions of Social Security and Medicare tax. To put sole proprietors roughly on par with W-2 employees who pay only the employee portion, half of the Social Security and Medicare tax for a sole proprietor may be deducted from income. This deduction is computed on Schedule SE and reported on the sole proprietor’s Form 1040. With Schedule C income of $60,000, the one-half SE tax deduction is $4,239. How to compute the SE tax number is beyond the scope of this article, but we would love for you to contact us about it.

Subtracting $4,239 from the $60,000 Schedule C income leaves us with $55,761. The sole proprietor’s earned income and employer contribution both have to come from this amount. We want a contribution of 10% of pay. Can we just multiply $55,761 by 10%? No. This gives us a contribution of $5,576, but the $5,576 has to be subtracted from $55,761, which leaves us with $50,185, which $5,576 is not 10% of.

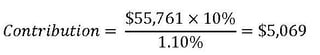

Instead, we multiply $55,761 by 10% and then divide by one plus 10% (1.10%), as follows:

Then, earned income equals $55,761 minus $5,069, which equals $50,692. Indeed, $5,069 is 10% of $50,692. This formula gives us the answer we need.

Adding Employees, Deferrals, Outside Income to the Mix

If there are other employees besides the sole proprietor, their contributions need to be finalized before the sole proprietor’s earned income is computed. Contributions to employees have already been subtracted out by the time you get to line 31 of Schedule C. The sole proprietor’s earned income cannot be determined until the contributions to employees are known.

What if the contributions to employees are not known? In a cross-tested plan, sometimes the contributions employees are given depend on what the sole proprietor is given, and vice versa. In that case, it’s trial and error. You will need to keep jumping back and forth between the contributions to employees and those to the sole proprietor until you reach an equilibrium amount that satisfies both the employer objectives and the nondiscrimination testing. This can be time-consuming.

Other comments about earned income calculations are as follows:

- An LLC taxed as a sole proprietorship is treated the same way for this purpose as a pure sole proprietorship.

- Sole proprietor contributions are based on earned income, which is derived as described above. How much a sole proprietor takes in “draws” throughout the year is not relevant for this purpose.

- Some sole proprietors have W-2 income from employment elsewhere. In this case, the deduction on Schedule SE may be smaller than if there were no outside W-2 income.

- A sole proprietor may make salary deferrals in a 401(k) plan just like a W-2 employee. Even though these contributions are deductible by the sole proprietor on his Form 1040, they normally are not subtracted out when determining earned income, unlike employer contributions. The 401(k) deferrals would be subtracted out only if the plan document called for plan compensation to be reduced by the amounts deferred. Such a provision penalizes employees who save for retirement and is not usually part of the plans we work on.

Sole proprietors fall into a category called “self-employed individuals.” Other self-employed individuals are partners in a partnership and members of LLCs that are taxed as partnerships. In a future article, we will see how earned income is determined for such partners and LLC members.