David J. Kupstas, FSA, EA, MSEA Chief Actuary

There is some confusion in Retirement Plan Land about who needs to file Form 5500-EZ and who doesn’t, according to an IRS compliance project. Some plan sponsors are turning to the wrong people for advice, not reading the form’s instructions, or both.

Form 5500-EZ is the slimmed-down version of the annual Form 5500 return series for qualified retirement plans such as 401(k), profit sharing, and defined benefit plans. “One-participant plans” are eligible to file Form 5500-EZ. A one-participant plan covers individuals who own the entire business (which may be incorporated or unincorporated) as:

- a 100% business owner (and his or her spouse), or

- one or more partners and their spouses (no common law employee participants).

If a plan covers someone who is not an owner, partner, or spouse, the plan is not a “one-participant plan” for this purpose even if the number of participants in the plan is in fact one.

There are quite a few plan sponsors who are supposed to file Form 5500-EZ but are failing to do so. Why? Many sponsors said their financial or investment advisor didn’t tell them about the filing requirement. Oops! Fortunately, there is a relatively new correction program available, which we are big fans of. The usual penalty for failing to file a Form 5500-EZ is $25 per day up to $15,000. Under the correction program, the penalty is reduced to the low, low amount of $500 per return (up to a maximum of $1,500 per plan).

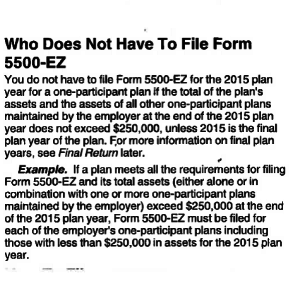

Others are not filing because they must have heard or read that they are exempt from filing if the plan’s assets are $250,000 or less. That is partially true. The rule is that all one-participant plans of the employer combined have to be $250,000 or less. It is not plan by plan. It says so right in the instructions under “Who Does Not Have To File Form 5500-EZ.” See the graphic above. Also in the instructions is a comment that a 5500-EZ must be filed in the plan’s final year even if assets are less than $250,000. Some are not aware of this.

Interestingly, some are filing 5500-EZs for IRA-based plans such as SEPs and SIMPLE IRAs. IRAs do not have to file 5500s. It is ironic that anyone would file a 5500-EZ for a SEP or SIMPLE IRA since one of the selling points of these arrangements is their simplicity, including not having to deal with 5500s. Maybe those that file 5500-EZs for SEPs and SIMPLE IRAs should get extra credit of some sort.

The Form 5500 filing is one of the most basic requirements of qualified retirement plans. That so many seem to be missing it entirely for EZs is troubling. Hopefully, this IRS bulletin will get in the hands of those who are acting as retirement plan advisors who need to see it. Likewise, plan sponsors should take it upon themselves to verify that their plans are in compliance. If a plan sponsor is not already working with someone who specializes in retirement plans, then it needs to go find someone who does.