Jimmy Pickert, CFA, CRPS® Portfolio Manager

November 2017 marked the ten-year anniversary of the beginning of the bear market associated with the Great Financial Crisis (GFC). Since the end of that bear market in March 2009, investors have more or less had an enjoyable and profitable ride in the markets. Considering our attention spans as humans continue to decrease, we’d like to take this opportunity to remind investors of a central tenet of investing that is incredibly simple and yet often ignored: diversifying before the next crisis, not during it or after it occurs. In other words, we’d like to stress the importance of taking a proactive approach rather than a reactive one.

The reasoning behind this is mathematical: when you experience a certain percentage loss in your portfolio, you will always require a greater percentage gain in order to recoup your losses. If you lose 25 percent, you need a 33 percent gain to recoup the loss. If you lose 50 percent, you’ll need a 100 percent gain to get back to where you were.

It can potentially take several years to experience a 100 percent return in your portfolio, even if you’re taking on a lot of risk by investing all of your money in stocks. It will take even longer if you reduce your portfolio risk in the middle of a crisis (e.g., selling stocks and buying bonds when things get tough), because you would have experienced all of the downside and only a portion of the ensuing upside.

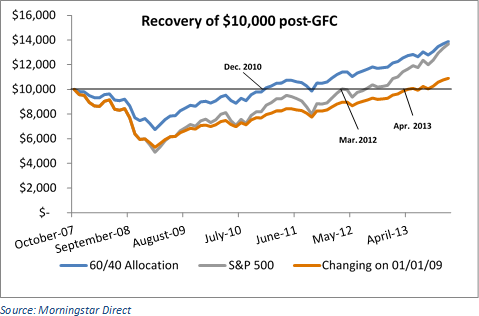

This is even better illustrated through the lens of real dollars and real returns experienced during the last crisis. The bear market of the GFC began in late October 2007 and ended in March 2009. Imagine, for a moment, you have two investors that each have  $10,000 invested right before the market begins to crash. One investor, Ralph, has his entire $10,000 portfolio invested in the S&P 500 index of U.S. company stocks. The other investor, Ned, has split his $10,000 so that 60 percent is invested in the S&P 500 index and 40 percent is invested in the more stable Lehman Aggregate Bond Index (now named the Bloomberg Barclays US Aggregate Bond Index). As the graph below demonstrates, Ned’s “60/40 portfolio” (blue line) loses a lot less than Ralph’s (gray line), and thus Ned’s account gets back to $10,000 by December 2010. Ralph, on the other hand, lost a lot more during the GFC and therefore it takes him until March 2012—an additional 15 months—to break even. Hopefully Ralph was not planning to retire any time soon.

$10,000 invested right before the market begins to crash. One investor, Ralph, has his entire $10,000 portfolio invested in the S&P 500 index of U.S. company stocks. The other investor, Ned, has split his $10,000 so that 60 percent is invested in the S&P 500 index and 40 percent is invested in the more stable Lehman Aggregate Bond Index (now named the Bloomberg Barclays US Aggregate Bond Index). As the graph below demonstrates, Ned’s “60/40 portfolio” (blue line) loses a lot less than Ralph’s (gray line), and thus Ned’s account gets back to $10,000 by December 2010. Ralph, on the other hand, lost a lot more during the GFC and therefore it takes him until March 2012—an additional 15 months—to break even. Hopefully Ralph was not planning to retire any time soon.

In fact, there is another investor we should consider: Timmy. Timmy, like many investors out there, doesn’t realize he’s taken on too much risk until it’s too late. Timmy (orange line) invested all of his money in the S&P 500 index just like Ralph. But after losing a lot through the end of 2007 and 2008, Timmy decided he couldn’t tolerate the losses anymore so he switched to a 60/40 portfolio at the beginning of 2009. Timmy may have avoided some losses toward the end of the bear market, but the losses he had already incurred were so significant that he didn’t fully recoup them until April 2013—a full 28 months later than Ned!

What’s the takeaway? Don’t let your fear of missing out on market gains impact how you approach investing. Make sure your investment portfolio reflects your goals and your risk tolerance now rather than wait until you’re in the middle of the next bear market. Not only should this save you money next time the market drops, but you’ll be able to sleep more soundly now that you know you’re not overexposed to market risk.

Other posts you may be interested in: