Bobby Moyer, CFA, CFP®, CAIA Chief Investment Officer

The Federal Reserve began raising the Federal Funds interest rate in December of 2015. They raised rates again in 2016 and twice so far in 2017 with the possibility of another increase later this year. With four rate hikes so far in this rate raising cycle, many investors are concerned that the Fed’s policy change will have a negative impact on the stock market.

The Truth About the Federal Reserve

Before getting into the impact of interest rates on the stock market, it’s important to address a major misconception about the Fed’s influence on interest rates. The Fed actually doesn’t control all interest rates. They can usually only impact shorter-term rates, while longer-term rates are influenced by market forces such as inflation and economic growth expectations. To demonstrate this, let’s look at the 10-year Treasury rate. The 10-year Treasury yield finished 2015 at 2.27 percent however, interest rates moved lower during the first half of 2016 when the yield actually fell below 1.50 percent. As of August 17, 2017, the current yield was below 2.20 percent, which is lower than where the yield was when the Fed started raising rates almost two years ago.

To drive this point home even more, when the Fed began this rate hiking cycle the average interest rate on the 30-year home mortgage was about 4 percent, yet over the next 10 months mortgages dropped below 3.50 percent and are currently slightly below 4 percent even after the Fed raised rates four times.

Rising Interest Rates and Stocks

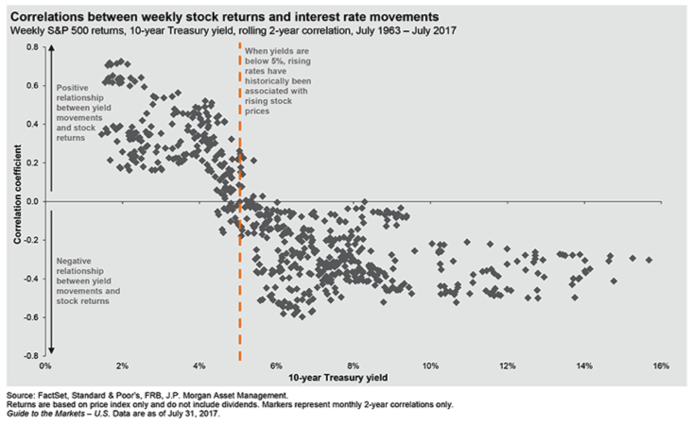

Over the past several years there has been plenty of suggestion that rising interest rates are a bad sign for stocks. Historical data shows that the relationship between stocks and interest rates is more nuanced, depending in large part on the current level of interest rates rather than just whether they’re rising or falling. JPMorgan provided the chart below in their quarterly “Guide to the Markets”; the chart shows weekly S&P 500 returns, 10-year Treasury yield, and rolling two-year correlation. The takeaway is that when interest rates are low and moving higher, stock prices tend to rise along with interest rates. However, once interest rates are already somewhat high, further rate increases tend to correlate with negative stock returns. Generally speaking, when the 10-year Treasury yield is below 5 percent there is a positive correlation. Currently, the 10-year Treasury yield is around 2.20 percent, much lower than the historical point at which the movement of interest rates is negatively correlated to stock price movements.

Good News for the Economy

If you think about it, this makes sense. Lower interest rates stimulate the economy, and the Fed tries to keep rates low until they believe the economy can withstand higher interest rates. The low-interest environment creates a runway for the economy for future years. Low rates make housing, cars and other big-ticket goods more affordable, which creates demand for jobs and production. Companies hire people to meet demand, which results in more people earning a paycheck and being able to spend money on goods and services. Historically, this also leads to wage increases, although in the current economic cycle this has been slow to materialize. Better economic conditions result in higher consumer and business confidence.

As confidence grows, consumers overpurchase and companies overproduce until the economy is overheated, inflation is running above 2 percent and the Fed is raising rates trying to calm inflation. These late cycle, aggressive rate increases by the Fed may be a catalyst for an economic recession. Market cycles could also be influenced by outside events, like terrorist attacks or other black swan events, but typically expansionary cycles could last for years.

What This Means for Investors

While the decision by the Fed to begin to raise interest rates may signal a change in policy and the beginning of a period of Fed tightening monetary policy, it does not signal the end of a bull market. The Fed is supposed to, and generally does, make monetary policy decisions based on current economic conditions. We are hopeful that the Fed continues to raise rates in future years because that means the Fed believes the economy is strong enough to withstand higher rates. Once rates are higher and inflation is consistently hitting above target, the Fed may need to raise rates at a faster pace than they are comfortable with; at that point, it may be a concerning signal of an upcoming recession. Right now, interest rates are low and there is no indication of runaway inflation in the near term, both of which are good signs for the stock market.

At ACG, we are no stranger to monetary policy adjustments made by the Federal Reserve. As an investor, you need a well-seasoned expert who understands the relationship between stocks and interest rates and can offer the best advice to achieve your goals. Let's talk about our highly customized, disciplined approach to investments.