Jimmy Pickert, CFA, CRPS® Portfolio Manager

Opening up a 529 Plan is the best way to save for education expenses. In addition to providing a great means by which one can save for the ever-increasing costs of education, there are current and future tax benefits to enjoy.

College related expenses—particularly tuition—have risen at a much higher rate than normal inflation. In the past decade, the average increase has been 5 percent annually. If we assume that these expenses continue to rise at their current rate, the following annual cost can be expected in 18 years:

- Public in-state: $60,863

- Public out-of-state: $98,527

- Private: $122,497

This means that the average total cost of a four-year degree starting in 18 years is forecasted to be between $240,000 and $490,000. Such high expenses may be daunting, even for families who are otherwise financially secure. Saving early is critical because the compounding effects of investment returns and tax incentives will substantially lessen the overall bill.

Tax Incentives

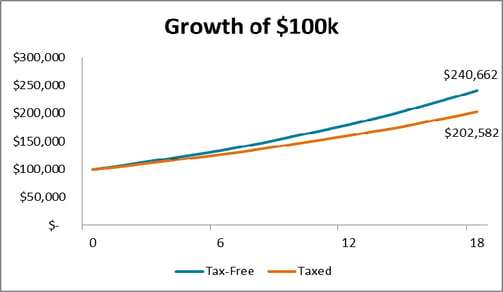

One great tax incentive of a 529 plan is that investment income and gains are not subject to taxes. This may not mean much in any given year, but over 10-20 years it results in plenty of savings. An example is shown in the chart to the right. $100,000 is invested in both a tax-free account (like a 529 plan) and a taxable account. Each account gets an average return of five percent per year, but the taxable account has 20 percent of its gains taxed each year. After 18 years, the tax-free account has grown by over $38,000 more than the taxable account.

One great tax incentive of a 529 plan is that investment income and gains are not subject to taxes. This may not mean much in any given year, but over 10-20 years it results in plenty of savings. An example is shown in the chart to the right. $100,000 is invested in both a tax-free account (like a 529 plan) and a taxable account. Each account gets an average return of five percent per year, but the taxable account has 20 percent of its gains taxed each year. After 18 years, the tax-free account has grown by over $38,000 more than the taxable account.

In addition to those compounding tax benefits, there are income and estate tax benefits to be enjoyed by contributing to a 529 plan. While contributions are not deductible for federal income tax purposes, Virginia allows up to $4,000 in 529 contributions to be deducted from state income tax returns each year. If more than $4,000 is contributed in a given year, the excess amount may be carried forward for deduction in future years. For a husband and wife filing jointly, the maximum amount deductible each year is doubled.

Contributing to 529 plans is also a good way for high net worth families to reduce estate and gift taxes while transferring wealth from one generation to the next through the use of the gift tax exclusion. This exclusion allows a person to give up to $15,000 per year, or $75,000 over a five-year period, without their gift being subject to the gift tax. The exclusion limit is determined on a per recipient basis, not a per giver basis. Please note that Virginia’s 529 Program accepts contributions until all account balances for the same beneficiary reach $500,000.