Bobby Moyer, CFA, CFP®, CAIA Chief Investment Officer

See our recap of April's key statistics and market commentary below.

Noteworthy Numbers

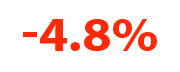

The initial reading of Q1 GDP in the U.S. showed a -4.8% annualized decline as a result of depressed economic activity through the COVID-19 response.

The initial reading of Q1 GDP in the U.S. showed a -4.8% annualized decline as a result of depressed economic activity through the COVID-19 response.

The spot price of a barrel of WTI Crude Oil went negative for the first time ever in April, falling to a low of -37.63. Oil rebounded from those lows by month end but is still beneath $20/barrel.

The spot price of a barrel of WTI Crude Oil went negative for the first time ever in April, falling to a low of -37.63. Oil rebounded from those lows by month end but is still beneath $20/barrel.

The number, in millions, of jobless claims filed in the last six weeks.

The number, in millions, of jobless claims filed in the last six weeks.

Our Take

The market drama continued in April as stocks saw a heroic rally for the month. The S&P 500 had its best monthly return since 1987, returning 12.82%. Interest rates ended by and large where they began the month, with the yield on the 10-year treasury finishing April at 0.61%. Mid- and small-cap companies, which were punished more throughout the decline into March, saw as strong or stronger returns than the large-cap S&P 500. Mid- and small-cap returns were 14.15% and 12.7%, respectively. It’s important to note that all equity indices are still negative year-to-date due to the severity of the decline, with the S&P 500 negative by 9.29% so far in 2020.

The big market moves came against the backdrop of a global economy that is still running in lockdown mode as countries around the world grasp for the appropriate next steps in responding the COVID-19 pandemic. During April, the United States CDC released a set of guidelines for individual states to reopen their economies in three phases, dependent on metrics related to the spread and relative containment of the virus. It appears that many states will adhere to these guidelines, but some have already begun easing their social distancing policies. Deciding how and when to normalize policy has become an increasingly political conversation, and the reality is that even the experts are relying on educated guesses and forecasting models with assumptions built in that may not pan out. Critical unknowns remain, including the possibility and severity of a second wave hitting the U.S. in the fall or potentially sooner, whether therapeutics will be identified, approved and manufactured on a sufficient scale in time for a second wave, and, most importantly, when countries can expect the creation and wide distribution of a vaccine for the virus. Until these questions are answered it will be difficult to assess true economic loss, as well as whether stocks were justified in their April rally or if the market was trading on unrealistic expectations.

The rebound in April seemed to come from a number of different factors. One that we can state with certainty is that markets and investors are encouraged by the Fed’s apparent willingness to do whatever it takes to prop up the economy and capital markets until the current storm has been weathered. This was first signaled back in March as the Fed cut rates and announced unprecedented asset purchase programs and was reinforced on April 29th as Chair Powell announced that the Fed intended to keep rates at zero until the economy was on sounder footing. Another factor buoying the April markets was the increasing sense that policy makers at the state level will decide to ease restrictions on businesses sooner than the CDC advises. This has become a topic fraught with emotion on both sides of the aisle, with some claiming the economic cost of extended shutdowns outweighs the benefits of mitigating the virus’ spread, while others claim that such action will prolong, rather than shorten, the economic duress because it will invite additional waves that could otherwise be avoided. Also promising were developments in the search for treatments and the development of a vaccine. In particular, Gilead Sciences announced promising results from the study of a drug called Remdesivir, while Oxford researchers were taking meaningful steps as well toward a vaccine development.

It’s also worth pointing out that the highest weighted companies in the S&P 500 (which is weighted by company market capitalization) are the tech goliaths which are not only surviving, but in some cases thriving throughout this crisis. Apple, Amazon, Microsoft, Facebook and Alphabet comprise approximately 20% of the S&P 500 market cap and for different reasons have either seen an increase in business activity (Amazon hiring hundreds of thousands of workers to meet demand) or are insulated from the crisis (Facebook’s ad revenue is down as fewer businesses can afford to spend but its user time is up because the entire world is sitting at home). The tech giants can only carry the S&P 500 so far, though, and the index will likely not be able to sustain this rally if a broader set of companies don’t begin to catch up.

Perhaps the most bizarre component of April’s rally came from the Energy sector. Not only did the cost of a barrel of WTI Crude Oil go negative for the first time ever—at one point all the way to -$37.63—but the Energy sector led all other sectors in the S&P 500, posting a 29.78% return. While it is true the price of oil went positive again relatively quickly, it still finished the month pretty much where it began at just under $20 per barrel, a multi-decade low. The only sound explanation for the mismatch between oil’s plummet and Energy’s rally is that the sector was far oversold through March, and April was simply a rebound from an absurdly low valuation. After all, Energy is still negative for the year by 35.70% through the end of April.

Those calling for a “V” shaped recovery may feel vindicated after the month of April, but in our view it is too early to say. Regardless of how soon lockdown guidelines are lifted, it’s nearly impossible to predict what the near- and middle-term impacts of recent events on the consumer psyche will be—either from a financial security perspective or a personal health concern. As investors it’s less important to predict what will happen in the short-term and more important to build a long-term investment strategy. Entering a crisis like this with the proper amount of portfolio risk—and sticking to it during the market upheaval—is what determines an investor’s long-term success.

Get Monthly Insights Delivered to Your Inbox