Bobby Moyer, CFA, CFP®, CAIA Chief Investment Officer

See our recap of November's key statistics and market commentary below.

Noteworthy Numbers

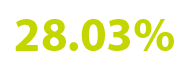

The S&P SmallCap 600 returned 18.17% in November, leading US stock asset classes in what was its best month of the year.

The US Dollar weakened to its cheapest value against the Euro since April 2018 when it fell to 1.20 in November.

Our Take

Just like Thanksgiving, November was all about the side dishes. The S&P 500, the turkey, had been the only game in town all year as the big tech stocks in that index pulled returns higher while the rest of the equity market remained depressed in the wake of Q1’s COVID-19 selloff. That all changed in November, with mid- and small-caps in the U.S. as well as developed and emerging markets abroad—all the side dishes— outpacing the S&P 500, in most cases by wide margins. Value stocks also rallied significantly compared with Growth stocks. The leading asset class in November was Small Cap Value, which notched a 19.2% return, followed by Mid Cap Value (16.6%) and Small Cap Growth (17.2%). It’s not that the S&P 500 had a bad month—it still rose by 10.95%, it’s just that almost everything else blew it out of the water. Even bonds (the tofurkey?) had a good month, with the Bloomberg Barclays Aggregate Bond Index picking up 0.98%.

The stock market opened strong on the first day of November, the day before Election Day, and never looked back. As it became evident that Joe Biden would win the presidential election and highly likely that Republicans would retain Senate control, markets rejoiced in response to what many view as a “Goldilocks” scenario. With Biden, much of the unpredictability of the Trump era will leave the White House; with the Senate staying red, the prospect of taxes going up has been effectively eliminated for at least the next two years. January’s two run-off elections in Georgia could obviously disrupt this outlook, but at this point those races are expected to be won by Republicans.

While the markets did rise significantly in that first week of November, the rally looked very much like the previous several months: Large US Growth stocks leading the way. That all changed on November 9, when Pfizer announced its COVID-19 vaccine was 90% effective. It immediately marked the return of the “traditional economy” stocks in the Energy, Financial and Industrial sectors—not the tech behemoths that profited in a “work from home” environment. While the Technology and Consumer Discretionary sectors are still leading for the year by a wide margin, the gap was closed substantially. Pfizer’s announcement was just the beginning in a string of very positive COVID-19 related news, as both Moderna and AstraZeneca also announced vaccines that were at least as effective as Pfizer’s. The estimates on distribution suggest Americans will begin getting vaccinated this December and that a substantial portion of the country will be vaccinated by the end of the second quarter next year. It’s worth noting that this last point on the breadth of distribution next year won’t matter if there still remains widespread public skepticism about taking the vaccine. In any case, this is a great reminder that the stock market is a forward-looking mechanism. While it is true that we are currently in the midst of a surge in the virus, with local officials in many parts of the country reinstating lockdown orders, the prospect of conditions normalizing in 2021 appears likely and the market reflects that.

The positive conditions described above, combined with a Fed that appears intent on keeping rates at zero for the foreseeable future, creates a bullish setting for investors as we get ready to leave 2020 behind us. As we caution investors to remain calm and confident during periods of turmoil, so too do we like to manage euphoria and the sense of invincibility during periods of extreme growth. For starters, equity valuations are stretching to ever more expensive levels, with the 12-month forward price-to-earnings ratio of the S&P 500 at 21.95 as of November 27, well above the long-term average of 16.5. Admittedly, valuations aren’t a great predictor of equity returns over the short term, but they still matter. Secondly, the U.S. economy is still in dire need of a new round of stimulus from Congress. The jobs market recovery has shown signs of slowing down and investors shouldn’t let the promise of a vaccine distract them from the long term impacts a new lockdown period could have in the next few months. Apparently, markets are counting on a stimulus to alleviate things, but if we see more partisan gridlock under the new government next year, expectations may have to be lowered.

The key to long term success in investing is to check your fear when things are bad and your greed when things are good. Last month we cautioned investors to stay the course and stay invested in their strategy even if the election outcome and COVID-19 created market turbulence. This month we aim to pull your emotions in the opposite direction, away from unalloyed optimism, but to the same practical advice: stick to your investment strategy and don’t chase returns. Use this period of calm to objectively evaluate whether your risk level matches your long-term goals.

Get Monthly Insights Delivered to Your Inbox