Bobby Moyer, CFA, CFP®, CAIA Chief Investment Officer

See our recap of November's key statistics and market commentary below.

Noteworthy Numbers

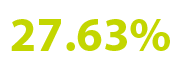

The S&P 500 is positive for the year by 27.63%, on track for its best calendar year return since 2013.

The US added 128,000 non-farm payrolls in October, far surpassing the consensus estimate of 89,000 jobs.

The US added 128,000 non-farm payrolls in October, far surpassing the consensus estimate of 89,000 jobs.

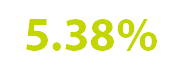

The tech sector led the S&P 500 in November with a 5.38% return.

The tech sector led the S&P 500 in November with a 5.38% return.

Our Take

Wherever investors looked in November, whether the Thanksgiving Day table or the stock market, it was an embarrassment of riches. The gravy train that is the S&P 500 continued to run during the second-to-last month of the year, posting a plump 3.63% return and bringing the index to a 27.63% return year-to-date. The large cap stock turkey wasn’t the only hit this month— the side dishes were phenomenal, too. Mid and small cap stocks were positive by 2.92% and 3.06%, respectively; both developed and emerging markets abroad made money in November, too. It was a modest month for fixed income investments—the Bloomberg Barclays Aggregate Bond index was just slightly positive due to a mild uptick in interest rates, but conservative investors are still giving thanks in a year when most bond indexes are enjoying high single digit returns.

With the Fed apparently on pause after last month’s rate cut (the third since it began its “mid-cycle adjustment” earlier this past summer) markets have primarily been driven by the ebb and flow of hope around the U.S.-China trade deal. Right now it is more flow than ebb, with Trump saying on November 26th that negotiators were close to reaching an initial trade deal. It’s amazing to see the market bite so easily on trade optimism when former announcements from both the Trump and Xi sides of the debate have turned out to carry such little weight this year. After all, markets surged in October after the announcement of “phase one” of the trade deal being complete, only to hear later that both sides were in disagreement over certain key aspects of this phase one deal. We aren’t necessarily skeptical about an eventual deal being reached, but we continue to suspect that domestic political considerations by both sides are delaying any real resolution.

Markets were volatile this time last year, and while much of that was due to fundamental concerns like the pace of Fed rate hikes, trade concerns and slowing global growth, the downward pressure was amplified by massive amounts of tax loss harvesting by retail and institutional investors. You may recall headlines about record-breaking outflows from mutual funds coming out in December. This was a bit misleading, as the implication was that investors were outright fleeing from risky assets like stocks; while this was true for some, many were selling mutual funds to avoid large capital gain distributions. By contrast, all signs point to a calmer December in 2019. There are less fundamental concerns (at least of the variety that the markets seem to care about) and while there will be plenty of capital gain distributions from mutual funds, market returns have been so strong this year that in most circumstances investors won’t be incentivized to sell. Expect that reporting on consumer activity during the holidays, as well as the jobs announcement on December 6th, will set the narrative for the remainder of the year. The Fed’s monetary policy statement is expected to have changed little when it’s released on December 11th, so any deviation from the status quo may impact markets.

We usually sign off these newsletters with a reminder to take stock of your current financial situation and make sure that your portfolio is positioned with the right amount of risk for your unique goals and objectives. In addition to doing that, we encourage you to review any remaining tax-related “to-dos” before time runs out in 2019. If you need to take a required distribution from an IRA, if you planned to make any charitable contributions or if you have any harvestable losses in your portfolio, take care of it now instead of later in December when you’re juggling other responsibilities around Christmas and New Year’s. This will be our last newsletter of 2019, so we’d like to wish all of our readers happy holidays and let you know that we look forward to keeping you informed about the markets in 2020.

Get Monthly Insights Delivered to Your Inbox