J. Saunders Wiggins, CFP®, AIF® CEO/President

401(k) plan fees and expenses are a fact of life for plan sponsors and participants. Like any service provider, 401(k) providers must be compensated for their services. This compensation comes in the form of 401(k) plan fees.

As a plan sponsor, you have a fiduciary duty to know and understand what these fees and expenses are and ensure that they are reasonable. This doesn’t necessarily mean that you’re responsible for paying the lowest fees possible. However, it does mean that you should know whether the fees being charged are appropriate based on the level of service offered by the plan provider.

Let’s take a look at what is included in 401(k) plan fees.

What Do 401(k) Plan Fees Cover?

As a general overview, the primary services provided for which 401(k) plan fees are charged are:

- Custody fees - The custodian is responsible for holding on to the plan participants’ money and keeping it safe.

- Recordkeeping fees - The recordkeeper facilitates the transfer of funds from participants’ pay into their 401(k) accounts, as well as hosts the participant website, and answers the toll-free phone number participants can call with questions when they need help. Recordkeeping is directly related to custody.

- Administrative fees - These are managerial fees paid to the plan provider associated with the process of plan design as well as handling the accounting and tax return filing for 401(k) plans. They also conduct the annual discrimination testing that’s required.

- Mutual fund expense ratios - The mutual fund expense ratio is the total percentage of fund assets used to cover the fund’s total annual operating expenses. These include administrative, management, advertising (12b-1), and all other expenses related directly to the fund.

- Investment Advisory fees – These fees cover the ongoing monitoring and oversight of 401(k) plan investments.

- Audit fees - Audit fees cover an independent financial review of the retirement plan. This fee is only applicable if your plan has 100 or more participants.

How Are 401(k) Plan Fees Paid?

401(k) plan fees can be paid in several different ways.

Mutual fund expense ratios are deducted directly from the return of the fund. All other fees can be paid by:

- The plan sponsor

- Deducted from participant accounts.

- A combination of the two.

In a typical scenario, the plan sponsor will pay administrative fees while the rest of the fees are charged to plan participants’ accounts.

However, when fees are paid this way, the plan sponsor cannot deduct them on their company tax return. So, it may be preferable from a tax point of view for all fees (except expense ratios) to be paid by the plan sponsor.

How Are 401(k) Plan Fee Payments Structured?

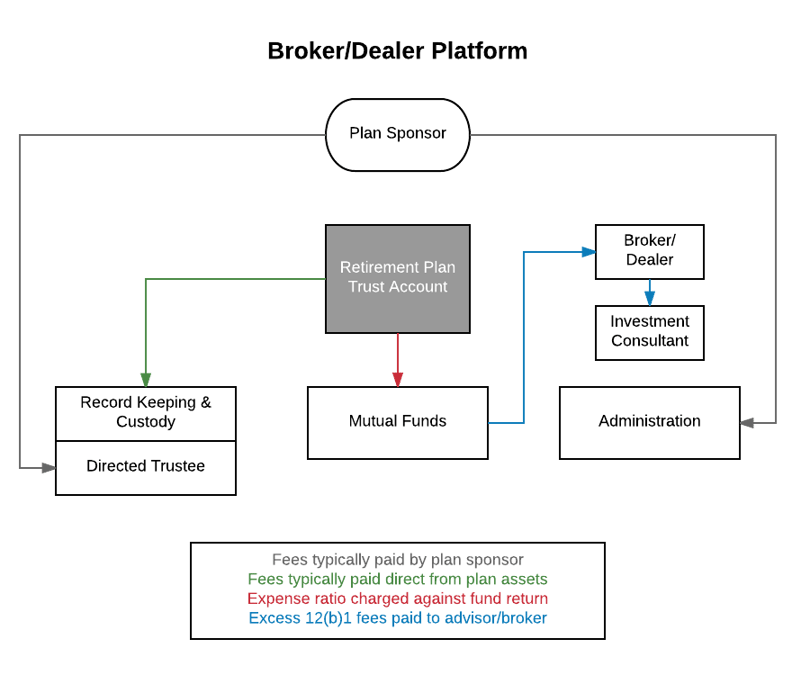

Two main platforms can be used in the structure of 401(k) plan fee payments: a broker/dealer platform and an RIA platform.

.png?width=900&name=ACG%20Fee%20Flow%20Chart%20-%20Page%201%20(1).png) Choosing the right platform structure is critical, and it will be determined largely by the size of your company and the demographics of the participants in your plan. For example, small or mid-sized companies wouldn’t want to use a platform structured for a Fortune 500 company. A large corporation might require tools that aren’t needed — and your plan and participants may end up paying extra fees and expenses.

Choosing the right platform structure is critical, and it will be determined largely by the size of your company and the demographics of the participants in your plan. For example, small or mid-sized companies wouldn’t want to use a platform structured for a Fortune 500 company. A large corporation might require tools that aren’t needed — and your plan and participants may end up paying extra fees and expenses.

As a plan sponsor, you have a responsibility to determine what services are really necessary for your employees and your plan’s operations. You must also obtain these services at reasonable, although not necessarily the lowest, fees and expenses.

Need Help With Your 401(k) Plan Fees?

Understanding 401(k) plan fees and payment options can get complicated. At ACG, we specialize in helping small and mid-sized firms understand 401(k) plan fees so they can make an informed decision on how to pay them. From this complete and transparent understanding of applicable fees, plan sponsors are better positioned to meet their fiduciary responsibilities.

Contact us today to schedule a no-obligation meeting to discuss your 401(k) plan fees and expenses in more detail.